amazon flex taxes form

Its almost time to file your taxes. Internal Revenue Service regulations require Amazon to post your 1099 by January 31st.

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

You can plan your week by reserving blocks in advance or picking them each day based on your availability.

. In your example you made 10000 on your 1099 and drove 10000 miles. Tap Forgot password and follow the instructions to receive assistance. Amazon Flex drivers receive 1099-NEC forms from the company according to online reports.

This video shares information on where to find your 1099 expenses you should take into account to reduce your taxable i. We know how valuable your time is. Whats new for tax year 2020.

The amount of tax and National Insurance youll pay will depend on how much money is left over after deducting your flex expenses tax allowances. 12 tax write offs for Amazon Flex drivers. TIN foreign non-US income tax identification number both or neither.

Knowing your tax write offs can be a good way to keep that income in. How to Calculate Your Tax. Adjust your work not your life.

How do you get your Amazon Flex 1099 tax form. Select Sign in with Amazon. Report Inappropriate Content.

With Amazon Flex you work only when you want to. Whatever drives you get closer to your goals with Amazon Flex. With Amazon Flex you work only when you want to.

Payment processors including Amazon Payments file a Form 1099-K to report unadjusted annual gross sales or payment. The forms are also sent to the IRS so take note if youve made more than 600. We would like to show you a description here but the site wont allow us.

This form will have you adjust your 1099 income for the number of miles driven. Ad We know how valuable your time is. Gig Economy Masters Course.

However in the event that you dont receive the form and you made. If you earn at 600 per tax year driving for Amazon Flex expect a 1099-NEC form in the mail from them by late Januaryearly February of the following year. With Amazon Flex you work only when you want to.

Service income to be reported on Form 1099-NEC to US. Internal Revenue Service IRS regulations require that US. The IRS only requires Amazon Flex to send drivers the 1099 form if you made over 600 the previous year.

Get started now to reserve blocks in advance or pick them daily based on your schedule. Increase Your Earnings. Amazon Flex quartly tax payments.

Self Employment tax Scheduled SE is automatically generated if a person has 400 or more of net profit from self-employment. Choose the blocks that fit your. If you still cannot log into the Amazon Flex app.

If youre an Amazon seller living in the US then youre probably aware that tax time is coming up. Adams 1099 NEC Forms 2021 Tax Kit for 12 Recipients 5 Part Laser 1099 Forms 3 1096 Self Seal Envelopes Tax Forms Helper Online TXA12521-NEC 45 out of 5 stars 558. If you dont want to wait for your 1099 you have two options.

The Internal Revenue Service IRS is requiring nonemployee compensation eg. Sign out of the Amazon Flex app. Blue Summit Supplies 1099 NEC Tax Forms 2021 50 4 Part Tax Forms Kit Compatible with QuickBooks and Accounting Software 50 Self Seal Envelopes Included.

Driving for Amazon flex can be a good way to earn supplemental income. The first option is to enter your income in your tax software as income you didnt receive a. Businesses such as partnerships S corporations or LLCs that are taxed as.

Tax Identification Number TIN Choose one of the four answer options to indicate if you have a US. You can find your 1099-NEC in Amazon Tax Central. You pay 153 SE tax on 9235 of your Net.

Self Employment tax Scheduled SE is generated if a person has 400 or more of net profit from self.

Anyone Else Getting This Exactly 5000 00 Pay For 2019 I Have Trouble Believing That My Random Blocks And Whole Foods Flex Delivery Work Paid Me Exactly 5000 00 R Amazonflexdrivers

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

Completing Your Tax Information In Seller Central For Amazon Payments Youtube

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

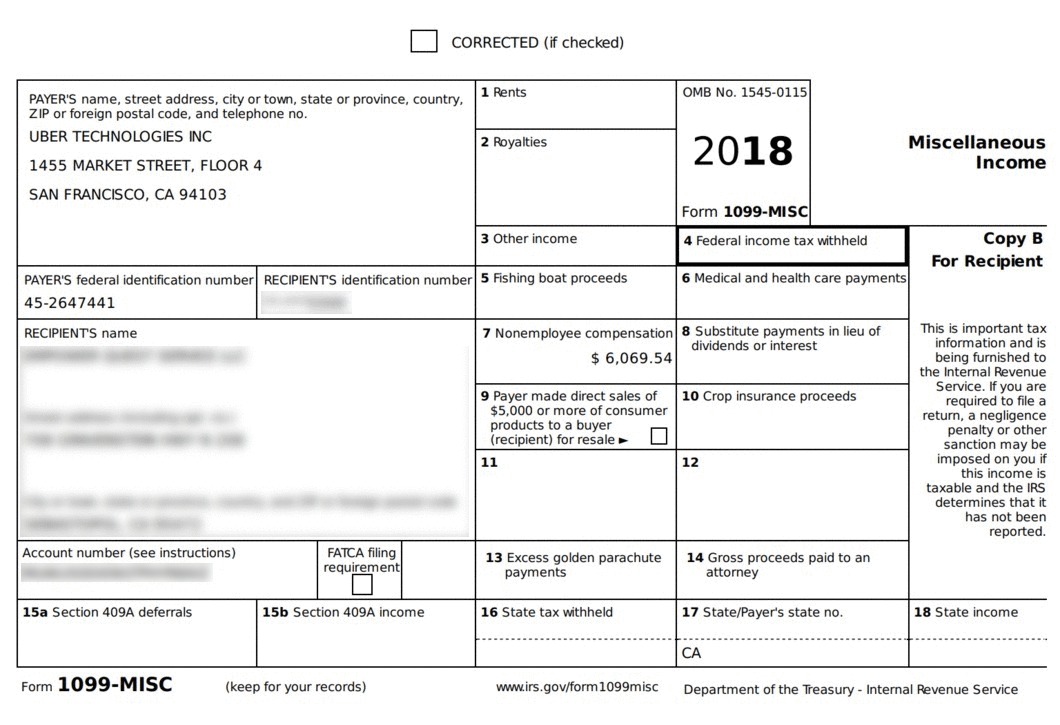

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

What Is A 1099 Form What Freelancers Need To Know

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To File Amazon Flex 1099 Taxes The Easy Way

Does Amazon Flex Take Out Taxes In 2022 Complete Guide

Amazon Flex Tax Forms Info On Income Tax For Amazon Flex Drivers

How To File Amazon Flex 1099 Taxes The Easy Way

How To File Self Employment Taxes Step By Step Your Guide

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Amazon Flex Tax Forms Info On Income Tax For Amazon Flex Drivers